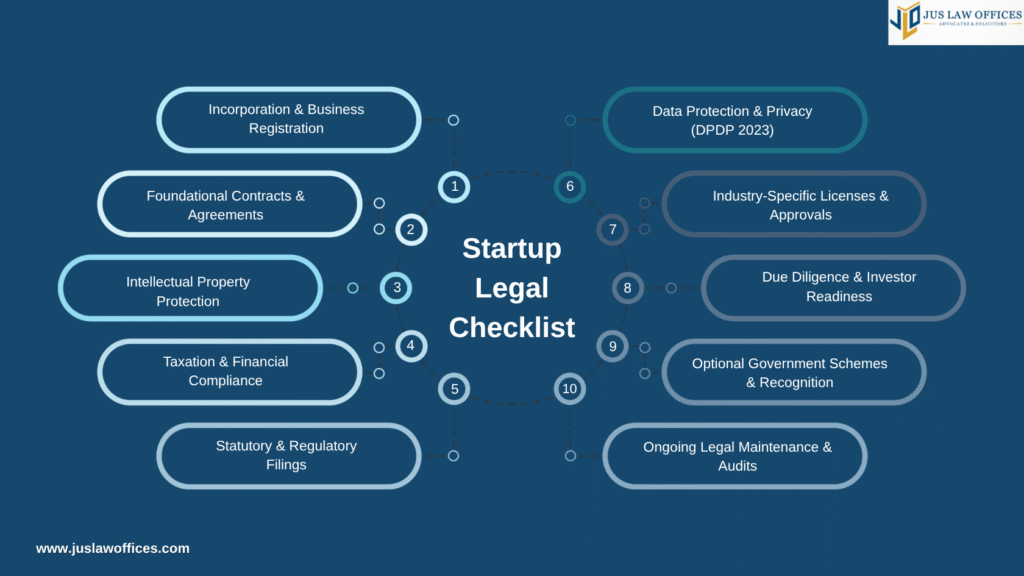

Starting and scaling a venture in India demands more than a great idea and execution, it requires a sound legal foundation. Whether you’re an early-stage startup or a growth-stage enterprise in tech, D2C, fintech, manufacturing, or services, this checklist will guide you through the essential legal and compliance steps as of June 2025.

1. Incorporation & Corporate Governance

- Entity Selection: Private limited company, LLP, or partnership? A private limited company often offers the best mix of investor appeal and regulatory clarity under the Companies Act, 2013.

- MOA & AOA: Draft your Memorandum and Articles of Association to define object clauses, capital structure, director powers, and quorum rules.

- Board & Shareholder Meetings: Comply with annual general meeting (AGM) timelines and board meeting requirements.

- Latest Update:

Companies (Amendment) Act, 2024 (effective Feb 2025) relaxed CSR thresholds and introduced optional e-AGMs for startups.

2. Founders’ & Shareholders’ Agreements

- Vesting & Clawback: Include vesting schedules (e.g., 4-year vesting with 1-year cliff) to secure co-founder commitment.

- Protective Clauses: Tag-along, drag-along, and pre-emption rights guard against unwanted dilution.

- Confidentiality & Non-Compete: Broadly drafted NDAs and non-compete obligations, mindful of DPDP Act constraints (see Section 5).

3. Intellectual Property (IP) Protection

- Trademarks: File under the Trade Marks Act, 1999 for brand names, logos, and slogans. Consider a “start-up fast track” under the 2021 IP policy.

- Patents: Under Patent (Amendment) Rules, 2025, startups can apply for expedited examination, cutting standard wait times by half.

- Copyrights & Designs: Register software code, website content, and industrial designs as needed.

4. Employment & Contractor Agreements

- Offer Letters & Appointment Contracts: Clearly define roles, remuneration, probation, and exit terms.

- ESOPs & Sweat Equity: Draft grant and vesting terms under the Companies Rules, ensuring compliance with tax implications.

- Labour Law Registrations: Shops & Establishment Act, PF/ESI, and professional tax registrations based on state rules (e.g., Delhi Shops & Establishment).

- Workplace Policies: POSH policy (sexual harassment) is mandatory under the Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013.

5. Data Privacy & Protection

- DPDP Act, 2023 Compliance: As of April 2024, every startup processing personal data must:

- Maintain a privacy policy on its digital assets

- Conduct Data Protection Impact Assessments (DPIAs) for high-risk processing

- Appoint a Data Protection Officer if processing large volumes of sensitive data

- Cross-Border Transfers: Comply with Standard Contractual Clauses when transferring data abroad.

6. Taxation & GST Compliance

- Income Tax Audit Threshold: From FY 2024–25, startups with >10 Cr turnover and >95% digital transactions require audit under Section 44AB.

- GST Registration & Returns:

- Mandatory registration if turnover > 20 L (N. E. states: 10 L), or interstate supply.

- E-Invoicing: Threshold raised to ₹10 Cr from April 1, 2025.

- File GSTR-1 (sales), GSTR-3B (monthly summary), and annual GSTR-9/9C (reconciliation).

- Start-Up Exemptions: The government continues lower GST rates on specified goods/services for recognized startups.

7. Sectoral & Regulatory Compliance

- Fintech: RBI’s Tokenisation Guidelines (effective June 30, 2025) require customer card data to be tokenised.

- Healthcare & FSSAI: D2C food/beverage startups must obtain FSSAI licenses and comply with Labelling Regulations, 2020.

- Environmental: Manufacturing units must secure approvals under the Air & Water (Prevention & Control of Pollution) Acts.

- Foreign Investment: Abide by FDI policy circulars—automatic vs. government route sectors and caps.

8. Recent Judicial & Regulatory Highlights (as of June 2025)

- Patent Rules, 2025: Startup-friendly provisions for faster processing.

- DPDP Act, 2023 Enforcement: Several advisories issued by MeitY in early 2025 on data breach reporting.

- GST Council (May 2025): Reduced late fee for small taxpayers under ₹5 L turnover.

Conclusion

A strong legal and compliance framework is non-negotiable for startup success. By proactively addressing incorporation, agreements, IP, employment, data privacy, taxation, and sector-specific rules, founders can focus on growth without legal surprises.

Disclaimer: This blog is for informational purposes only and does not constitute legal advice. Please consult a qualified legal professional for advice tailored to your specific circumstances.

FAQs

1. Is it mandatory for all startups to register as a private limited company?

No. While a private limited company offers better fundraising and scalability prospects, startups can also operate as LLPs or sole proprietorships depending on their size, sector, and funding plans. The choice should be guided by liability, compliance burden, and long-term goals.

2. Do early-stage startups need to file for IP protection immediately?

Yes, especially for brand names, logos, product names, and proprietary technology. Even early-stage ventures should secure their IP to avoid future conflicts and enhance valuation. Fast-track options are available under the 2021 IP policy for startups.

3. What are the key labour law obligations for startups hiring their first few employees?

Startups must comply with state-specific Shops & Establishment Acts, issue appointment letters, register for EPF and ESI (if thresholds are met), and implement mandatory policies like POSH (sexual harassment) even with a small team.

4. Is compliance under the DPDP Act, 2023 mandatory for all startups?

Yes. Any startup processing personal data—especially customer data—is required to comply with the Digital Personal Data Protection (DPDP) Act, 2023, regardless of size. Obligations include publishing a privacy policy, managing user consent, and reporting data breaches.

5. How can startups ensure they are due diligence-ready for investors?

Founders should maintain updated statutory registers, have all contracts and licenses documented, ensure IP filings are completed, and resolve any pending tax or compliance issues. Legal and financial hygiene is crucial for investor confidence during funding rounds.